| WewillprovidetheNoticeofInternetAvailabilityofProxyMaterials,electronicdeliveryoftheproxymaterialsormailingofthe2021ProxyStatement,the2020AnnualReportonForm10-KandaproxycardtoshareholdersbeginningonoraboutApril16,2021. By Order of the Board of Directors

Global Chief Legal Officer and Corporate Secretary April 16, 2021 Your Vote Matters: How to Vote | By phone | Online before the meeting | By mail | Online during the meeting |  You can vote your shares by calling 1-800-690-6903 (toll-free in the U.S. and Canada). |  Go to www.proxyvote.comand follow the instructions. |  Complete, sign and date the proxy card, and return it in the enclosed postage pre-paid envelope. |  Attend our annual meeting virtually by logging into the virtual annual meeting website and vote by following the instructions provided on the website. |

| jll.com |  | 2021 Proxy Statement 2 | 2021 Proxy Statement 2 |

Attending the 2021 Annual Meeting Webcast You are entitled to attend the virtual 2021 Annual Meeting online only if you were a shareholder of record at the close of business on Friday, April 1, 2021—the Record Date— or you hold a valid proxy for the 2021 Annual Meeting. We encourage you to log into the website and access the 2021 Annual Meeting webcast early. Online access to the 2021 Annual Meeting webcast at www.virtualshareholdermeeting.com/JLL2021 will open at approximately 8:45 a.m., Central Time, on May 27, 2021. Shareholders of Record (shares are registered in your name) If you were a shareholder of record of JLL common stock at the close of business on the Record Date, you are eligible to attend the meeting, vote, change a prior vote, and submit questions. To access the meeting, visit www.virtualshareholdermeeting.com/JLL2021 and follow the prompts, which will ask you to enter your 16-digit control number. The control number is shown in a box on your proxy card or, if applicable, shown in the Notice of Internet Availability of Proxy Materials.

Beneficial Shareholders (shares are held in the name of a bank, broker, or other institution) If you were a beneficial shareholder of JLL common stock as of the Record Date (i.e., you hold your shares through a broker or other intermediary), you may submit your voting instructions through your broker or other intermediary. To access the meeting, visit www.virtualshareholdermeeting.com/JLL2021 and use your 16-digit control number. You may vote your shares at the meeting or change a prior vote and submit questions. If you are a beneficial shareholder but do not have a control number, you may gain access to the meeting by contacting your broker or by following the instructions included with your proxy materials. Asking Questions If you are a shareholder of record or a beneficial shareholder, you may submit questions in writing during the meeting through the meeting portal at www.virtualshareholdermeeting.com/JLL2021 using your 16-digit control number. We will attempt to answer as many questions as we can during the meeting. Similar questions on the same topic will be answered as a group. Questions related to individual shareholders will be answered separately by our shareholder relations team. Our replies to questions of general interest, including those we are unable to address during the meeting, will be published on our Investor Relations website after the meeting. Control Number Your 16-digit control number appears in a box on your proxy card, in our Notice of Internet Availability of Proxy Materials, or in the instructions that accompanied your proxy materials. If you do not have a 16-digit control number, you may gain access to the meeting by contacting your broker or by following the instructions included with your proxy materials. Technical Support If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the phone number displayed on the virtual meeting website on the meeting date.  | 2021 Proxy Statement 3 | 2021 Proxy Statement 3

Table of contents April 19, 2018

YOUR VOTE IS VERY IMPORTANT. ANY SHAREHOLDER MAY ATTEND THE ANNUAL MEETING IN PERSON. IN ORDER FOR US TO HAVE THE QUORUM NECESSARY TO CONDUCT THE ANNUAL MEETING, WE ASK THAT SHAREHOLDERS WHO DO NOT INTEND TO BE PRESENT AT THE ANNUAL MEETING IN PERSON GIVE THEIR PROXY OVER THE INTERNET OR BY TELEPHONE. IF YOU PREFER, YOU MAY ALSO REQUEST A PAPER PROXY CARD TO SUBMIT YOUR VOTE BY MAIL. YOU MAY REVOKE ANY PROXY IN THE MANNER DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT AT ANY TIME BEFORE IT HAS BEEN VOTED AT THE ANNUAL MEETING.

PROXY STATEMENT SUMMARYjll.com |  | 2021 Proxy Statement 4 | 2021 Proxy Statement 4 |

Back to Contents This summary highlights certain information fromAbout JLL

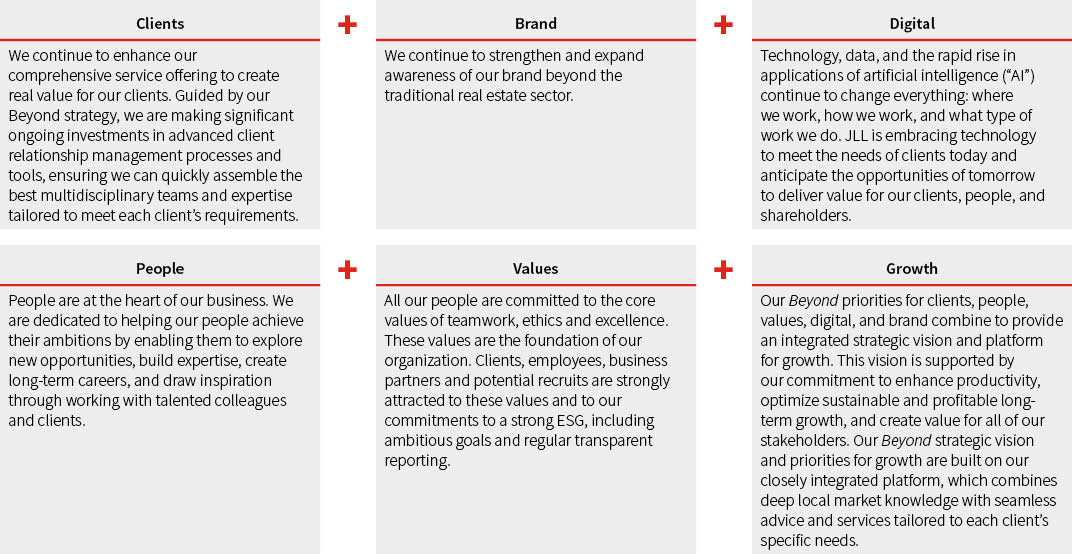

Our organizational purpose We shape the future of real estate for a better world Who we are We are a world leader in real estate services, powered by an entrepreneurial spirit. We want the most ambitious clients to work with us, and the most ambitious people to work for us. It’s as simple as that. We shape the future of real estate for a better world by using the most advanced technology to create rewarding opportunities, amazing spaces and sustainable real estate solutions for our clients, our people and our communities. We provide services for a broad range of clients who represent a wide variety of industries and are based in markets throughout the world. What we do To address the needs of real estate owners, occupiers and investors, we leverage our deep real estate expertise and experience to provide clients with a full range of the following services on a local, regional and global scale.  | Leasing | |  | Capital Markets | |  | Advisory, Consulting & Other | Full-service brokerage between tenants and landlords | | Investment sales and acquisitions, debt placement, equity placement, and financing arrangements | | Workplace strategy, digital solutions, valuation, consulting and advisory | | | | | | | | |  | Property & Facility Management | |  | Project & Development Services | |  | LaSalle | Management and outsourcing of properties and real estate portfolios | | Design and management of real estate projects including fit-out services | | Real estate investment management | | | | | | | | |

| 2021 Proxy Statement | 2021 Proxy Statement for the 2018 Annual Meeting of Shareholders.

You should read the entire Proxy Statement carefully before voting.5

Back to Contents Shareholder Voting Matters and Recommendations

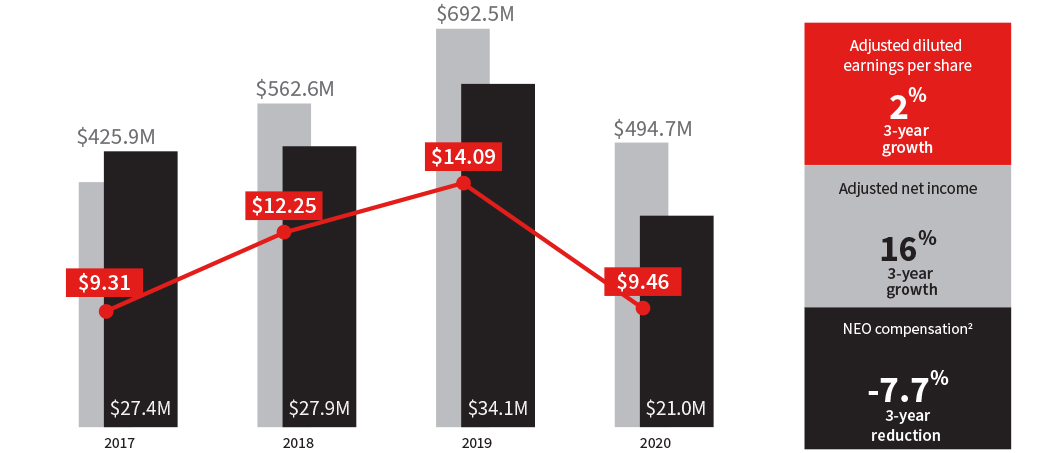

2020 Business highlights ItemRevenue | Board RecommendsFeeRevenue* | Reasons for Recommendation | MoreNet

InformationIncomeattributabletocommonshareholders

| 1. Election of ten directors$16.6 billion | Yes

✔$6.1 billion | The Board believes the ten Board candidates possess the skills, experience, and diversity to provide strong oversight for the Company’s long-term strategy and operations | Page S-1

and

Page 62$402.5 million | 2. Non-Binding “Say-on-Pay” Vote Approving Executive Compensation-8% from 2019 | Yes

✔-14% from 2019 | Our executive compensation programs demonstrate our pay-for-performance philosophy, and reflect the input of shareholders | Page 64 | 3. Ratification of Appointment of Independent Registered Public Accounting Firm | Yes

✔ | Based on its assessment of KPMG’s qualifications and performance, the Audit Committee believes the retention of KPMG for fiscal year 2018 is in the best interests of the Company | Page 65 |

-25% from 2019 Director Nominees for Election at the 2018 Annual Meeting

| Name | Age | Director

Since | Position | Independent | Audit

Committee | Compensation

Committee | Nominating

and

Governance

Committee | Other

Current

Public

Boards(1) | | Current Directors Who Are Nominees Standing for Re-Election | | Hugo Bagué | 57 | 2011 | Former Group Executive, Organisational Resources, Rio Tinto plc | Yes | — | Yes | Yes | — | | Samuel A. Di Piazza, Jr. | 67 | 2015 | Retired Global Chief Executive Officer, Pricewaterhouse Coopers International Ltd. | Yes | — | Yes | Yes | 3 | | Dame DeAnne Julius | 69 | 2008 | Chairman, University College London | Yes | — | Yes | Yes | — | | Ming Lu | 60 | 2009 | Partner, KKR & Co., L.P. | Yes | — | Chairman | Yes | — | | Bridget Macaskill | 69 | 2016 | Non-Executive Chairman, First Eagle Holdings, Inc. | Yes | Yes | — | Yes | 2 | | Martin H. Nesbitt | 55 | 2011 | Co-Chief Executive Officer, The Vistria Group, LLC | Yes | Yes | — | Yes | 2 | | Sheila A. Penrose | 72 | 2002; Chairman Since 2005 | Chairman of the Board, JLL | Yes | Yes | Yes | Chairman | 1 | | Ann Marie Petach | 57 | 2015 | Retired Chief Financial Officer, BlackRock, Inc. | Yes | Chairman | — | Yes | — | | Shailesh Rao | 46 | 2013 | Former Vice President for Asia Pacific, Latin America and Emerging Markets, Twitter, Inc. | Yes | — | Yes | Yes | — | | Christian Ulbrich | 51 | 2016 | Chief Executive Officer and President, JLL | No | — | — | — | 1 |

(1) | Reflects directors that are currently are, or at any other time during 2017 were, on boards of other publicly-traded entities. Additional information about other board service is described in the Proxy Statement under “Directors and Corporate Officers — Biographical Information; Composition of the Board of Directors.” |

People | Proxy Statement SummaryReturnedtoshareholders | S-1Investment-grade

creditratings |

2017 Business Highlights

We believe we remain well-positioned to take advantage of the opportunities in a consolidating industry and to navigate successfully the dynamic markets in which we compete worldwide. We are proud to be a preferred provider of global real estate services, an employer of choice, a consistent winner of industry awards, and a valued partner to the largest and most successful companies and institutions in the global marketplace.

Among its financial and operational highlights for 2017, JLL:

Generated revenue and fee revenue of $7.9 billion and $6.7 billion, respectively, across our four business segments, representing increases of 17% and 16%, respectively, over 2016.

Maintained our investment-grade balance sheet for growth, reflecting the Company’s strong cash generation.

•91,000 | As of December 31, 2017, our investment grade credit rating was BBB (Stable) with $100 million | BBB+ | colleagues in 80 countries | via share repurchases | Standard & Poor’s Ratings Services (S&P) and | | | Baa1 (Stable) with | | | Moody’s Investors Service, Inc. (Moody’s).Services |

As of December 31, 2017, ourLaSalle Investment Management business had assets under management of $58.1 billion, a decrease of 3% from 2016, with $4.8 billion of net capital raised during 2016.

Providedcorporate facility management services for 1.5 billion square feet of clients’ real estate,* Fee Revenue is a 7% increase from 2016. Over the same period, the JLL Corporate Solutions business had185 new business wins, 70 expansions of existing relationships, and 50 contract renewals. Completed five acquisitionsthat expanded our capabilities and increased our presencenon-GAAP financial measure, which is described in key regional markets including Australia, Germany, and Switzerland, as well asmore detail in the United States.

Providedcapital markets services for $169.8 billion in client transactions, a 25% increase from 2016, where the overall market was down 6% over the same period.

Completed approximately 17,700 agency leasing transactions for landlord and tenant clients, a 54% decrease from 2016, representing259 million square feet of space.

Please refer toAnnex A to this Proxy Statement. See Annex A to this Proxy Statement for a reconciliation of non-GAAP financial measures to our results as reported under generally accepted accounting principles inGAAP.

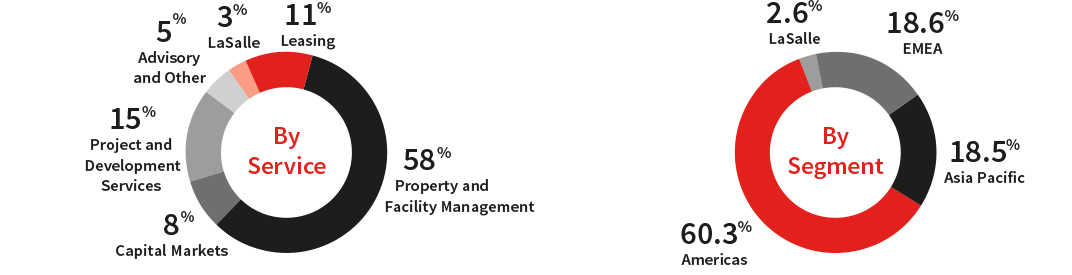

2020 Revenue Breakdown | jll.com |  | 2021 Proxy Statement 6 | 2021 Proxy Statement 6 |

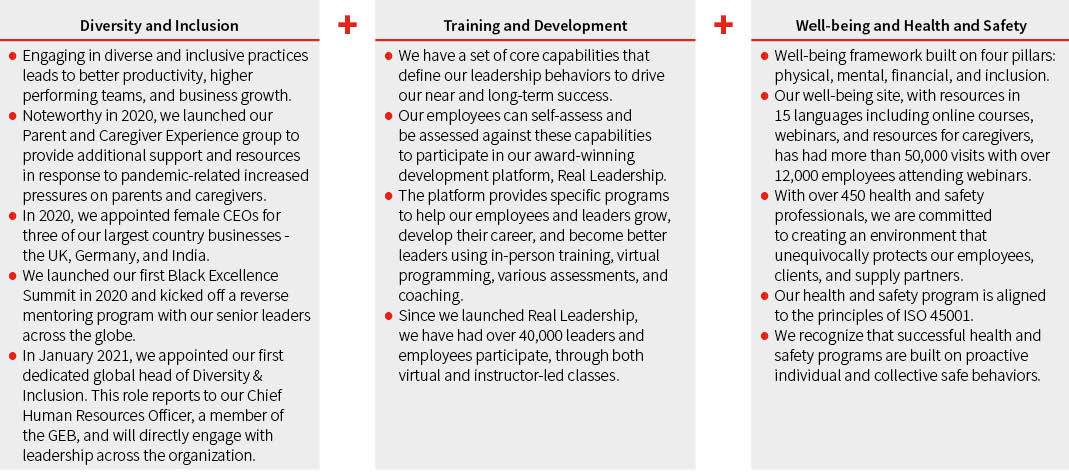

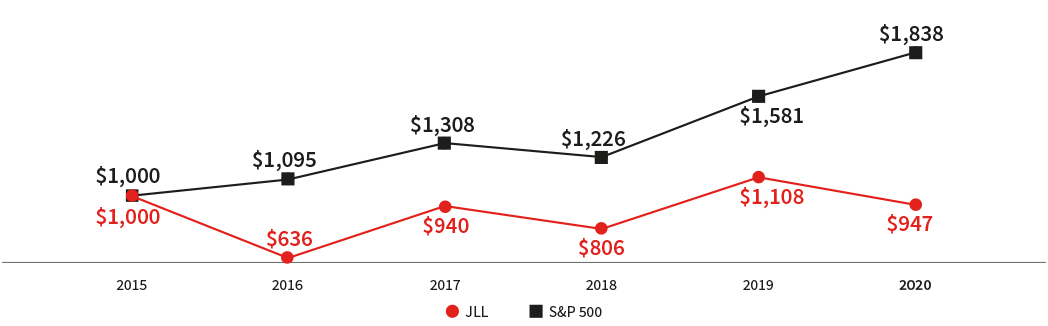

Back to Contents Human capital We maintain a human capital strategy that supports a diverse and inclusive workforce with equal opportunity and training and career advancement programs, strong benefits, incentives, well-being and health and safety. Corporate sustainability We partner with our stakeholders to drive innovative, impactful, sustainable change by embedding sustainability into everything we do. JLL’s most recent Global Sustainability Report is available on the United States.Sustainability page of our website at https://www.us.jll.com/en/about-jll/our-sustainability-leadership. In the report you can find the latest information on JLL’s sustainability efforts including our Task Force for Climate-related Financial Disclosure reporting, our Sustainability Accounting Standards Board disclosures, progress with setting our Science-Based Targets, and progress against our global sustainability goals. StockAwards and Dividend Performancerecognition

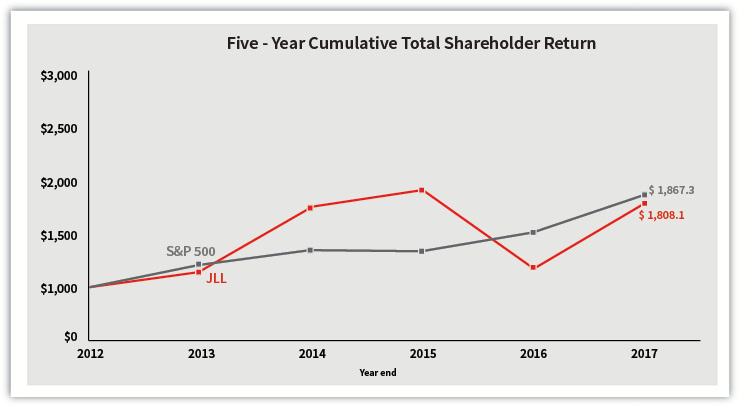

Over the calendar year ended December 31, 2017,the price of a share of our Common Stock increased 48%, which includes the reinvestment of dividends. We paid total dividends of $0.72 per share, up from $0.64 the previous year, an increase of 13%.

Industry Recognition

During 2017,In 2020, we continued to winearned numerous awards and recognitions that reflectedreflect our commitment to sustainability, the quality of the services we provide to our clients, the integrity of our people, and our desirability as a place to work, including:including being named:

2017 Awards● | • ForA member of the Bloomberg Gender-Equality Index, for the second consecutive year

| | ● | A member of the Dow Jones Sustainability IndexNorth America, • For for the tenthfifth consecutive year one

| | ● | One of theWorld’sAmerica's 100 Most EthicalSustainable Companies, by Barron's | | ● | An Energy Star Sustained Excellence Award recipient, by the Ethisphere Institute• ALinkedIn Top CompanyU.S. Environmental Protection Agency, for the ninth consecutive year

| | ● | One of America's Most Responsible Companies by Newsweek, for the second consecutive year • For

| | ● | One of the thirdWorld's Most Ethical Companies by the Ethisphere Institute, for the 13th consecutive year one | | ● | One of the100 Best Corporate Citizens in the United States (#27), CR Magazine, and #1 in the Financial Services / Insurance /Real Estate sector (for second consecutive year)• 100Best Companies, Working Mother

• For the second consecutive year,Top 60 Companies for Executive Women, National Association for Female Executives

| • For the second consecutive year,America’s most JUST company in the real estate industry, Forbes’ “JUST 100” list

• For the ninth consecutive year, one of theGlobal Outsourcing 100 - International Association of Outsourcing Professionals

• World’s World's Most Admired Companies, by Fortune Magazine,

• For the third consecutive year, one of the50 Out Front for Diversity Leadership: Best Places for Women & Diverse Managers to Work, Diversity MBA Magazine

• For the fourth consecutive year as having aperfect score on

| | ● | To the Human Rights Campaign Foundation’sFoundation's Corporate Equality Index, a national benchmarking survey on corporate policies and practices related to LGBTLGBTQ workplace equality,• For with a perfect score, for the sixthseventh consecutive yearEnergy Star Sustained Excellence Award

| | ● | One of America's Best Employers for Diversity by Forbes, for the U.S. Environmental Protection Agencysecond consecutive year | | ● | One of America's Best Employers for Women by Forbes | | ● | One of the Top Companies for Executive Women by Working Mother, for the fifth consecutive year | | ● | One of Working Mother's Best Companies for Dad | | |

| 2021 Proxy Statement 7 | 2021 Proxy Statement 7

| Proxy Statement Summary | S-2 |

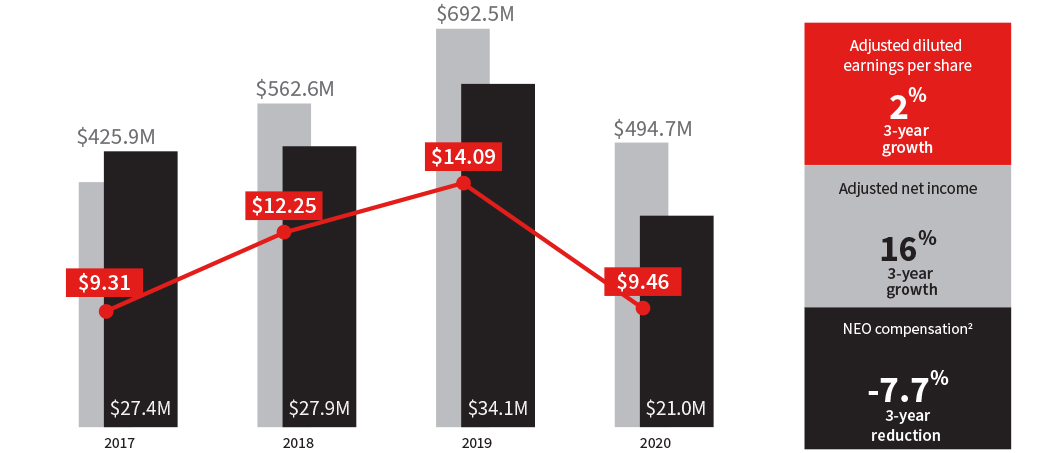

Financial PerformanceBack to Contents

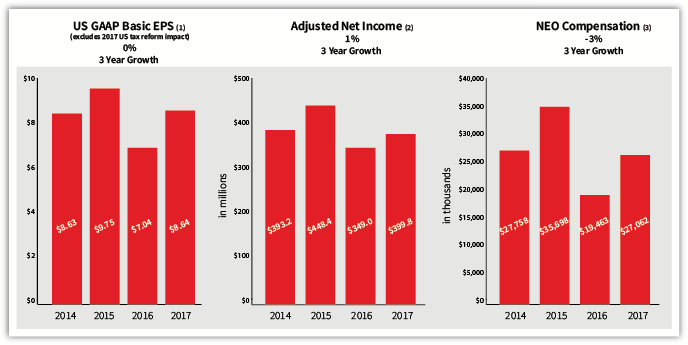

Proxy Statement Summary The following table presents key financial data for each ofThis summary highlights certain information from this Proxy Statement and does not contain all the last three fiscal years, all as of each year end.

| ($ in millions, except per share data) | | 2015 | | | 2016 | | | 2017 | | | Revenue | | $ | 5,966 | | | $ | 6,804 | | | $ | 7,932 | | | Total operating expenses | | | 5,436 | | | | 6,363 | | | | 7,396 | | | Operating income | | | 530 | | | | 441 | | | | 537 | | | Net income available to common shareholders | | | 438 | | | | 318 | | | | 254 | | | Diluted earnings per common share | | | 9.65 | | | | 6.98 | | | | 5.55 | | | EBITDA(1) | | | 707 | | | | 613 | | | | 745 | | | Total Assets | | | 6,187 | | | | 7,629 | | | | 8,015 | | | Total Debt(2) | | | 561 | | | | 1,268 | | | | 753 | | | Total Liabilities | | | 3,458 | | | | 4,808 | | | | 4,729 | | | Total Shareholders’ Equity | | | 2,689 | | | | 2,790 | | | | 3,243 | | | Cash Dividends Paid | | | 26 | | | | 29 | | | | 33 | |

The above information is qualified in its entirety bythat you should consider. You should read the entire Proxy Statement before voting your shares. For more detailed and complete information inregarding JLL’s 2020 performance, please review our Annual Report on Form 10-K for the year ended December 31, 2017. Please refer2020.

|  | When |  | Virtual Meeting |  | Record Date | | | Thursday, May 27, 2021 9:00 a.m., Central Time | | Via live audio webcast at www.virtualshareholder

meeting.com/JLL2021 | | Shareholders as of April 1, 2021 are entitled to vote |

Virtual meeting format Due toAnnex A COVID-19-related public health restrictions and for the safety and well-being of our shareholders, employees, directors and officers, the 2021 Annual Meeting will be conducted online through a live audio webcast. The accompanying Proxy Statement contains information about attending the 2021 Annual Meeting online. You will not be able to attend the 2021 Annual Meeting physically in person. Shareholder voting matters and recommendations The following table summarizes the items that will be brought for a reconciliationvote of non-GAAP financial measures to our results as reported under generally accepted accounting principles inshareholders at the United States.2021 Annual Meeting, along with our voting recommendations. Proposal | Vote Required to Adopt the Proposal | Board Recommends | Reasons for Recommendation | More Information | 1. Election of the eleven nominees to serve one-year terms on our Board of Directors | Majority of votes cast with respect to each nominee | For

each nominee | The Board believes the eleven Board nominees possess the skills, experience, and diversity to provide strong oversight for JLL’s long-term strategy and operations | See

page14 | 2. Approval, on an advisory basis, of our executive compensation (say-on-pay) | Majority of votes cast | For | Our executive compensation programs demonstrate our pay-for-performance philosophy and reflect the input of shareholders | See

page32 | 3. Approval of the Amended and Restated 2019 Stock Award and Incentive Plan | Majority of votes cast | For | Equity compensation helps to align the incentives of management and shareholders | See

page61 | 4. Ratification of the appointment of KPMG LLP as JLL’s independent registered public accounting firm for the year ending December 31, 2021 | Majority of votes cast | For | Based on its assessment of KPMG LLP’s qualifications and performance, the Audit Committee believes that retaining KPMG LLP for fiscal year 2021 is in JLL’s best interests | See

page75 |

YOUR VOTE MATTERS: HOW TO VOTE | | BY PHONE | ONLINE BEFORE THE MEETING | BY MAIL | ONLINE DURING THE MEETING |  You can vote your shares by calling 1-800-690-6903 (toll-free in the U.S. and Canada). |  Go to www.proxyvote.com and follow the instructions. |  Complete, sign and date the proxy card, and return it in the enclosed postage pre-paid envelope. |  Attend our annual meeting virtually by logging into the virtual annual meeting website and vote by following the instructions provided on the website. |

(1)jll.com | We define EBITDA attributable to common shareholders (EBITDA) as Net income attributable to common shareholders before (i) Interest expense, net of interest income, (ii) Provision for income taxes, and (iii) Depreciation and amortization. Although EBITDA is a non-GAAP financial measure, it is used extensively by management in normal business operations to develop budgets and forecasts as well as measure and reward performance against those budgets and forecasts, exclusive of the impact from capital expenditures, reflected through depreciation expense, along with other components of our capital structure. EBITDA is believed to be useful to investors and other external stakeholders as a supplemental measure of performance and is used in the calculation of certain covenants related to our revolving credit facility. However, this measure should not be considered an alternative to net income determined in accordance with U.S. generally accepted accounting principles (U.S. GAAP). Any measure that eliminates components of a company’s capital and investment structure as well as costs associated with operations has limitations as a performance measure. In light of these limitations, management also considers results determined in accordance with U.S. GAAP and does not solely rely on EBITDA. Because EBITDA is not calculated under U.S. GAAP, it may not be comparable to similarly titled measures used by other companies. |

(2) | Total Debt includes long-term borrowings under the Facility and Long-term senior notes (net of debt issuance costs for 2015, 2016, and 2017) and Short-term borrowings, primarily local overdraft facilities. |

|  | 2021 Proxy Statement | 2021 Proxy Statement Summary | S-38 |

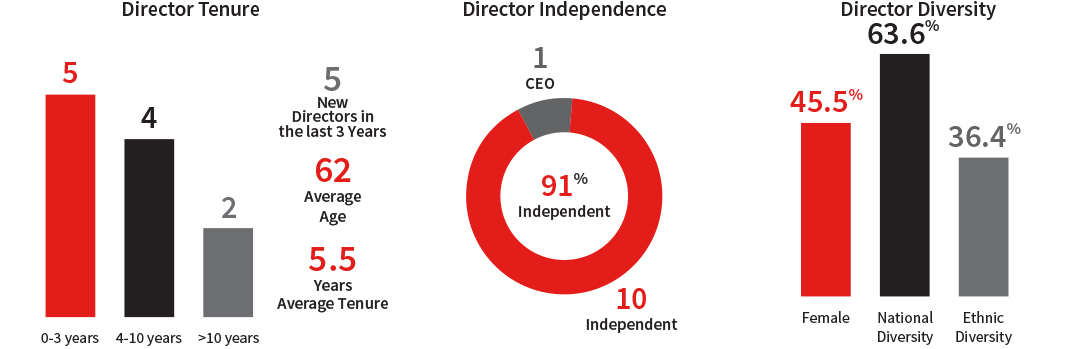

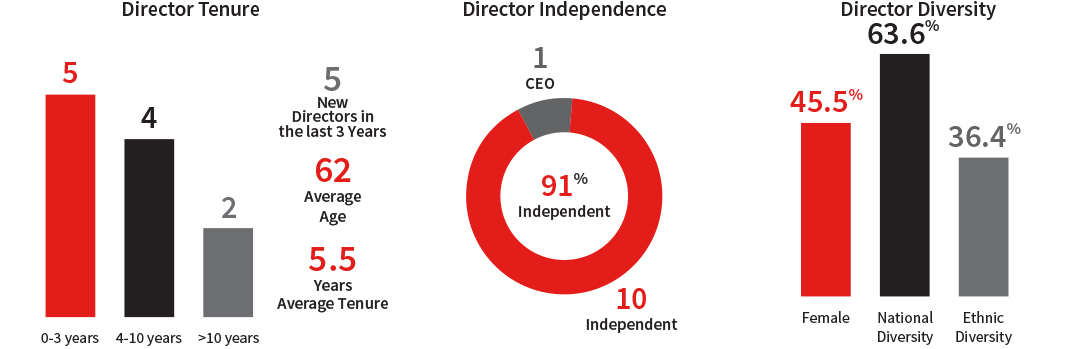

Back to Contents Our 2021 Director nominees Our current Board includes a diverse group of leaders in their respective fields. We believe their varied backgrounds, skills, and experience contribute to an effective and well-balanced Board that is able to provide valuable insight to, and effective oversight of, our senior executive team. Tina Ju is a first-time nominee for Director at the 2021 Annual Meeting. All the other nominees are currently serving on the Board. Each of Ming Lu and Martin Nesbitt, who are current Directors, is stepping down as a Director when his term ends at the 2021 Annual Meeting. As a result of these changes, our Board of Directors has determined to reduce the size of the Board to 11 members, assuming all nominees are elected at the 2021 Annual Meeting. Proxies cannot be voted for a greater number of directors than the 11 nominees identified in this Proxy Statement. The following table and the charts below provide summary information about each of our Director nominees. You can find more information about each Director’s background and experience beginning on page 15. Name | Age | Director Since | Position | Independent | Audit | Compensation | Nominating and Governance | Hugo Bagué | 60 | 2011 | Former Group Executive, Organisational Resources, Rio Tinto plc | Yes | |  | ● | Matthew Carter, Jr. | 60 | 2018 | Chief Executive Officer, Aryaka

Networks, Inc. | Yes | ● | | ● | Samuel A. Di Piazza, Jr. | 70 | 2015 | Retired Global Chief Executive Officer, PricewaterhouseCoopers

International Ltd. | Yes | | ● | ● | Tina Ju | 55 | First-time nominee | Managing member of the general partner of KPCB China and TDF Capital | Yes | | | ● | Bridget Macaskill | 72 | 2016 | Chairman of Cambridge Associates LLC and Former Non-Executive Chairman and Chief Executive Officer, First Eagle Holdings, Inc. | Yes | ● | | ● | Deborah H. McAneny | 62 | 2019 | Former Executive Vice President, Structured and Alternative Investments, John Hancock Financial Services, Inc. | Yes | | ● | ● | Siddharth (Bobby) Mehta | 62 | 2019 | Chairman of the Board, Former President and CEO, TransUnion | Yes | ● | ● | ● | Jeetendra (Jeetu) I. Patel | 49 | 2019 | Senior Vice President, Cisco Systems, Inc. | Yes | ● | | ● | Sheila A. Penrose | 75 | 2002 | Former Chairman of the Board, JLL and Retired President, Corporate and Institutional Services, Northern Trust Corporation | Yes | | ● |  | Ann Marie Petach | 60 | 2015 | Senior Advisor to the CFO of Google, Inc. and Retired Chief Financial Officer, BlackRock, Inc. | Yes |  | | ● | Christian Ulbrich | 54 | 2016 | Chief Executive Officer and President, JLL | No | | | |  Chair ● Member Chair ● Member | |

Corporate Governance

Our

| 2021 Proxy Statement 9 | 2021 Proxy Statement 9

Back to Contents Corporate governance highlights JLL’s mission as an organization is to deliver exceptional strategic, fully-integrated services, best practices, and innovative solutions for real estate owners, occupiers, investors, and developers worldwide. In order to achieve our mission, we realize we muststrive to establish and maintain an enterprise that will sustain itself over the long-termlong term for the benefit of all of itsour stakeholders, —including clients, shareholders, employees, suppliers, and the communities among others.in which we operate. Accordingly, we haveare committed ourselves to effective corporate governance that reflects best practices and the highest level of business ethics. To that end, and as the result ofThat commitment, informed by feedback offered during our shareholder engagement efforts, overhas prompted us to adopt the past years we have adopted the following significant corporate governance policies and practices:practices summarized below. Corporate governance policies and best practices Corporate Governance Policies and Practices | Board Practices | ● •All Non-Executivenon-executive Directors are Independent Directorsindependent (10 of 11 Board nominess at 2021 Annual Meeting are independent)

● • Separate Non-Executivenon-executive Chairman of the Board and Chief Executive Officer Rolesroles

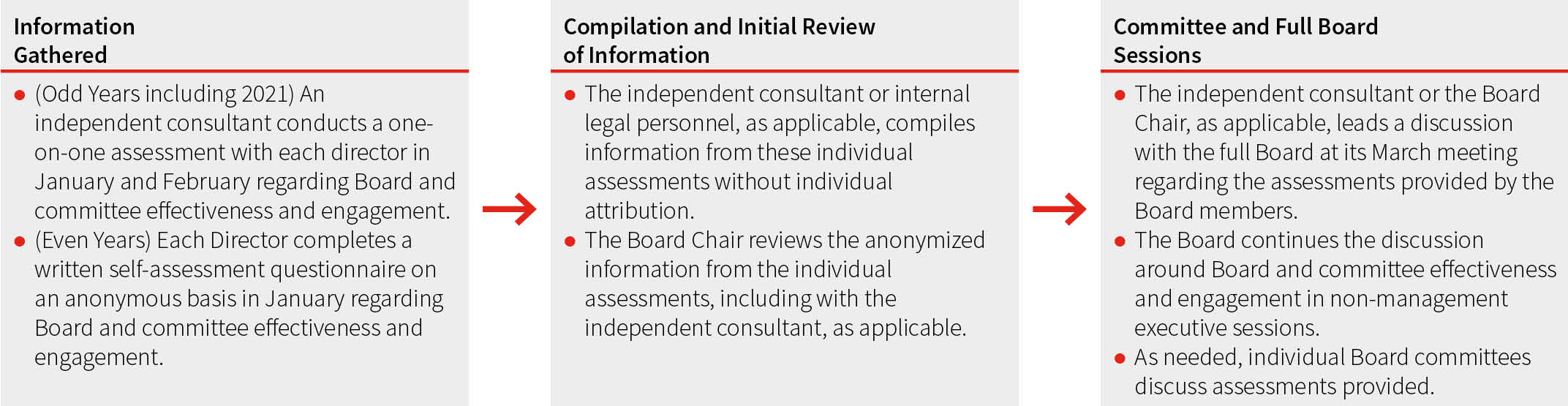

● •Annual Board and Committee Self-Evaluation, Includingcommittee self-evaluation, including bi-annually by Outside Facilitatoran outside facilitator

● • Highly Diversediverse Board (as toacross gender, ethnicity, and experience)experience

● •Regular Evaluationevaluation of Director Compensationcompensation

● • Significant Engagementengagement with Employees, Senior Managementemployees, senior management, and Clients at Board Meetings, Which Take Place Acrossclients, which takes place across our Major Offices Globallymajor offices globally

● •Annual Election of All Directors

• Directors Not “Over-Boarded”not “over-boarded”

•Two-Thirds of Board Stewardship Compensation is in Company Shares

| ● • No Perquisitesperquisites to Board Membersmembers

● •Board Orientation/Education Programorientation/education program

● • Company Code of Business Ethics Applicableapplicable to Directors

● •Majority Voting in Director Elections

• Related Party Transactions Policy Requiring Approvalrequiring approval by the Nominating and Governance Committee of any Related Party Transactionsrelated party transactions

● •Regular Succession Planningsuccession planning for Both Managementboth management and the Board

● • Stewardship Compensation Programprogram for Directors with No Separate Meeting Feesno separate meeting fees

● •Independent Directors Meet Without Management Presentmeet without management present at Each In-Person Meetingeach in-person meeting

● Two-thirds of base Board compensation is in JLL stock |

Shareholder Practices | ● Annual election of Directors ● • Adopted Majority voting in Director elections

● No poison pill in effect ● Proxy Access Rightaccess right ● •Process for shareholders to communicate with the Board

● Active Shareholder Engagementshareholder engagement | ● •Right of Shareholders Owningshareholders owning 30% of Outstanding Sharesoutstanding shares to Callcall a Special Meetingspecial meeting of Shareholdersshareholders for any Purposepurpose

● • Annual Shareholder “Say-on-Pay” Voteshareholder “say-on-pay” vote for Executive Compensationexecutive compensation

|

Other Best Practices | ● •Annual Evaluation of Board Effectiveness by Senior ManagementStock ownership guidelines for Directors and executives

● • Policy Against Pledgingagainst pledging and Hedging Company Stockhedging JLL stock

● •Disclosure Committeecommittee for Financial Reportingfinancial reporting

● • Increasingly Sophisticated Integrated Reportingsophisticated integrated reporting and corporate sustainability reporting

● Corporate Sustainability Reportingcompliance program ● •Corporate Compliance Program

• Company Makes Negligible Political Contributionspolitical contributions

|

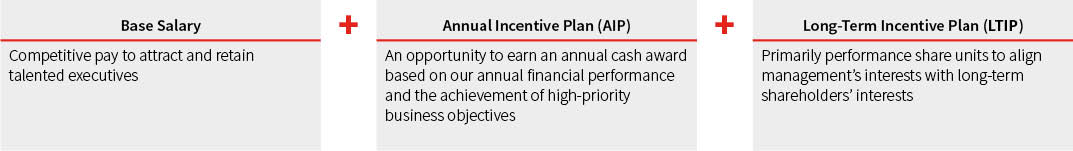

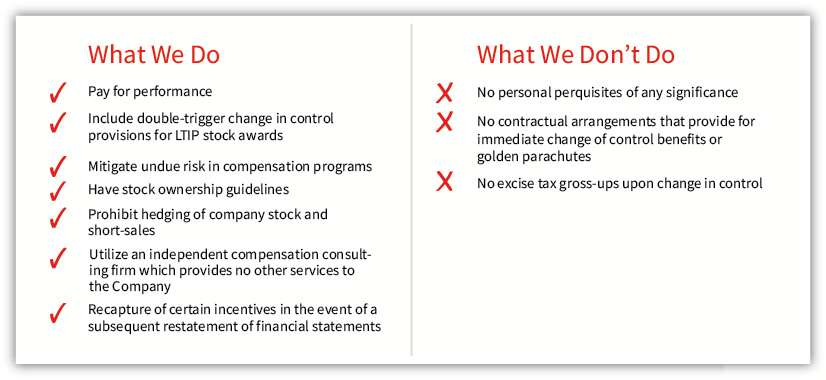

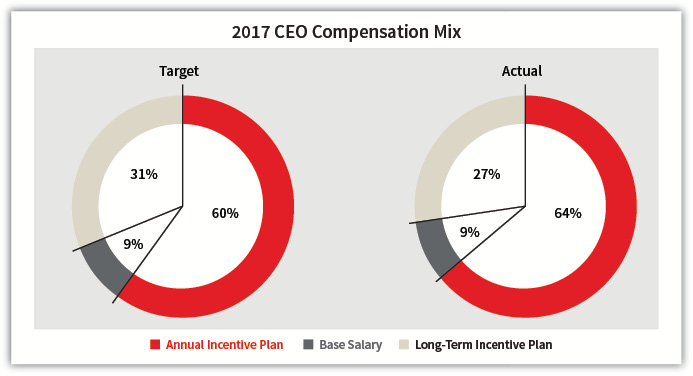

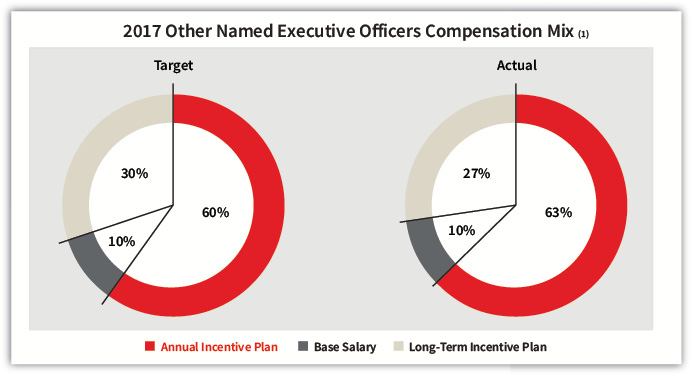

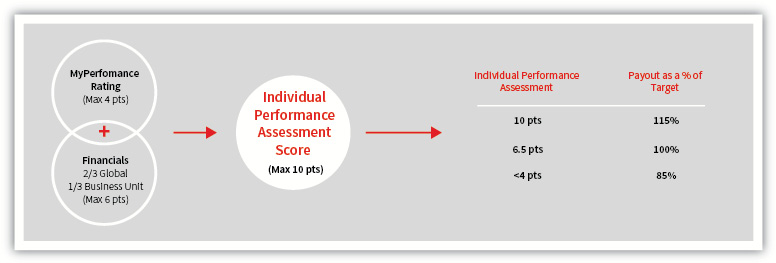

Objectives of Executive Compensation

| jll.com |  | 2021 Proxy Statement 10 | 2021 Proxy Statement 10 |

The principal objectives of the Compensation CommitteeBack to Contents

Components of our Board of Directors are to (1) align theexecutive compensation of each member of theprogram Our executive compensation program for our Global Executive Board our senior-most management group,(GEB) consists of a mix of fixed and the Company’s short-termshort- and long-term performanceincentive compensation. We believe our compensation program enables us to attract and retain top-quality executives who are motivated to act in the best interests of our shareholders, clients, staff, and other stakeholders. Our primary focus is on long-term incentive compensation to align with shareholder interests, (2) provide incentives for driving and meetingour annual incentive plan is designed as a supplement to drive business objectives in the Company’s strategic goals,near term. (1) Mr. Jacobson is excluded because he participated in a plan during 2020 that was not available to all GEB members. The above graphic reflects the 2020 temporary salary waivers by the CEO and (3) help attract and retain the leaders who will be crucialother NEOs agreed to in response to the Company’s long-term success and ultimate sustainability.COVID-19 pandemic that are described below under “Executive Compensation – 2020 base salary decisions”.  | 2021 Proxy Statement 11 | 2021 Proxy Statement 11

Back to Contents Wedo not provide any significant perquisites. Our Board of Directors has decided that restricted stock grants made to our senior executives in 2013 and beyond under our long-term incentive compensation plans have a“double trigger” in the case of a change in control(namely the executive’s employment must be terminated after the change in control in order for the restricted stock to vest on an accelerated basis).This page intentionally left blank

Shareholder Engagement; Compensation Program Changes for 2018

At our 2017 annual meeting, 56% of shares cast voted in favor of our advisory vote on executive compensation (Say-on-Pay). This was a significant departure from the strong support we have received from shareholders in 2016 (94.3% of votes cast) and in previous years. The 2017 results occurred even though the design of our incentive programs remained consistent year-over-year.

Based on the vote results, we conducted extensive engagement with our largest shareholdersBack to understand their specific concerns. Beginning shortly after the 2017 vote, management solicited 23 out of our largest 25 shareholders (representing 60% of our outstanding shares) and ultimately engaged with 13 shareholders (representing 42% of our outstanding shares).

Our discussions with shareholders were mostly prospective in nature, focusing on potential changes to the current incentive plans which are effective beginning with the compensation plans for 2018. For a more detailed discussion of the topics we heard in meetings with shareholders and our responses to the concerns raised, please refer to page 31 in our Compensation Discussion & Analysis.

| Proxy Statement Summary | S-4 |

Contents  Majority voting | 19 | DIRECTORS AND CORPORATE OFFICERS | 6 | Biographical Information; Composition of the Board of Directors | 6 | Director Qualifications | 6 | Current Board Composition and Nominees for Election | 6 | Changes During 2017 in Corporate Officer Positions | 6 | Current Non-Executive Directors Standing for Re-Election | 6 | Current Director Standing for Re-Election Who Is Also a Corporate Officer | 8 | Additional Corporate Officers | 8 | Section 16 Reporting Officers | 11 | CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | 12 | Information about the Board of Directors and Corporate Governance | 13 | Director Independence | 13 | Review and Approval of Transactions with Interested Persons | 13 | Non-Executive Chairman of the Board; Lead Independent Director | 14 | Director Orientation and Continuing Education | 14 | Annual Board Self-Assessments and Senior Management Assessments | 14 | Policy on Trading Stock; Policy Against Pledging or Hedging Stock | 15 | Board Meetings During 2017 | 15 | Standing Board Committees | 15 | The Audit Committee | 15 | The Compensation Committee | 16 | The Nominating and Governance Committee | 18 | The Board’s Role in Enterprise Risk Oversight | 19 | Nominations Process for Directors | 19 | Majority Voting for Directors | 21 | Calling for Special Shareholders’ Meetings | 22 | Non-Executive Director Compensation | 22 | Non-Executive Director Stock Ownership | 24 | Attendance by Members of the Board of Directors at the Annual Meeting of Shareholders | 25 | Communicating with Our Board of Directors | 25 | Corporate Sustainability | 25 | EXECUTIVE COMPENSATION | 26 | Compensation Discussion and Analysis | 26 | Executive Summary | 26 | How We Make Compensation Decisions | 32 | What We Pay and Why: Elements of Compensation | 35 | Compensation Committee Report | 45 | Executive Compensation Tables | 46 | Pay Ratio Disclosure | 55 | Additional Information | 55 | SECURITY OWNERSHIP | 57 | SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 59 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 59 | INFORMATION ABOUT THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 60 |

| | |

AUDIT COMMITTEE REPORTCorporate governance principles and Board matters | 61 | THREE PROPOSALS TO BE VOTED UPON AT THE ANNUAL MEETING | 62 | PROPOSAL 1:— ELECTION OF TEN DIRECTORS | 62 | PROPOSAL 2:— NON-BINDING ADVISORY “SAY-ON-PAY” VOTE APPROVING EXECUTIVE COMPENSATION | 64 | PROPOSAL 3:— RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 65 | PROXY DISTRIBUTION AND SOLICITATION EXPENSE | 66 | ANNEX AReconciliations of GAAP and Non-GAAP Financial Measures | A-1 | ANNEX BPay Ratio Excluded Employees | B-119 |

Non-employee Director compensation | As one of our shareholders of record on the Record Date,you are invited to attend the Annual Meeting. You are also entitled to vote on each of the matters we describe in this Proxy Statement.25 |

Executive officers | Aproxy is the legal designation you give to another person to vote the shares of stock you own. If you designate someone as your proxy in a written document, that document is called a proxy card. We have designated two of our officers as proxies for our Annual Meeting: Christian Ulbrich and Mark J. Ohringer. We are asking you to designate each of them separately as a proxy to vote your shares on your behalf.29 |

Q: | Why is JLL making these materials available over the Internet rather than mailing them? |

| 2021 Proxy Statement 13 | 2021 Proxy Statement 13

A: | Under the “Notice and Access Rule” that the United States Securities and Exchange Commission (theSEC) has adopted, we may furnish proxy materials to our shareholders on the Internet rather than mailing printed copies of those materials to each shareholder. This helps us meet oursustainability goals and it will save significant postage, printing, and processing costs. If you received a Notice Regarding the Availability of Proxy Materials (Notice of Internet Availability) by mail, you will not receive a printed copy of our proxy materials unless you specifically request one. Instead, the Notice of Internet Availability will instruct you about how to (1) access and review our proxy materials on the Internet and (2) access your proxy card to vote on the Internet or by telephone. |

Back to Contents We anticipate that weProposal 1 - Election of Directors

Our Board is presenting 11 nominees for election as Directors at our 2021 Annual Meeting. Each nominee currently serves as a Director, except Tina Ju, who is standing for election for the first time. Each Director elected will mailserve until the Notice of Internet Availabilitynext annual meeting and until a successor is duly elected and qualified. Each nominee has consented to our shareholders on or about April 19, 2018. Q: | How can I have printed copies of the proxy materials mailed to me? |

A: | If you received a Notice of Internet Availability by mail and you would prefer to receive a printed copy of our proxy materials, including a paper proxy card, pleasefollow the instructions includedbeing named in the Notice of Internet Availability. |

Q: | What information does this Proxy Statement contain? |

A: | The information in this Proxy Statement includes theproposals on which our shareholders will vote at the Annual Meeting, thevoting process, the compensation of our directors and certain executive officers, corporate governance, and certain other required information. It includes the information about JLL that we are required to disclose as the basis for your decision about how to vote on each proposal. |

Q: | What other information are you furnishing with this Proxy Statement? |

A: | Our2017 Annual Report, which includes our annual report on Form 10-K for the year ended December 31, 2017, has been made available on the Internet to all shareholders entitled to vote at the Annual Meeting and who received the Notice of Internet Availability. You may also view our 2017 Annual Report and this Proxy Statement atwww.jll.com in the “Investor Relations” section. |

You mayobtain a paper copy of our 2017 Annual Report and this Proxy Statement without charge by writing the JLL Investor Relations Department at the address of our principal executive office, 200 East Randolph Drive, Chicago, Illinois 60601, or by emailing JLLInvestorRelations@jll.com.

| Proxy Statement | Page | 1 |

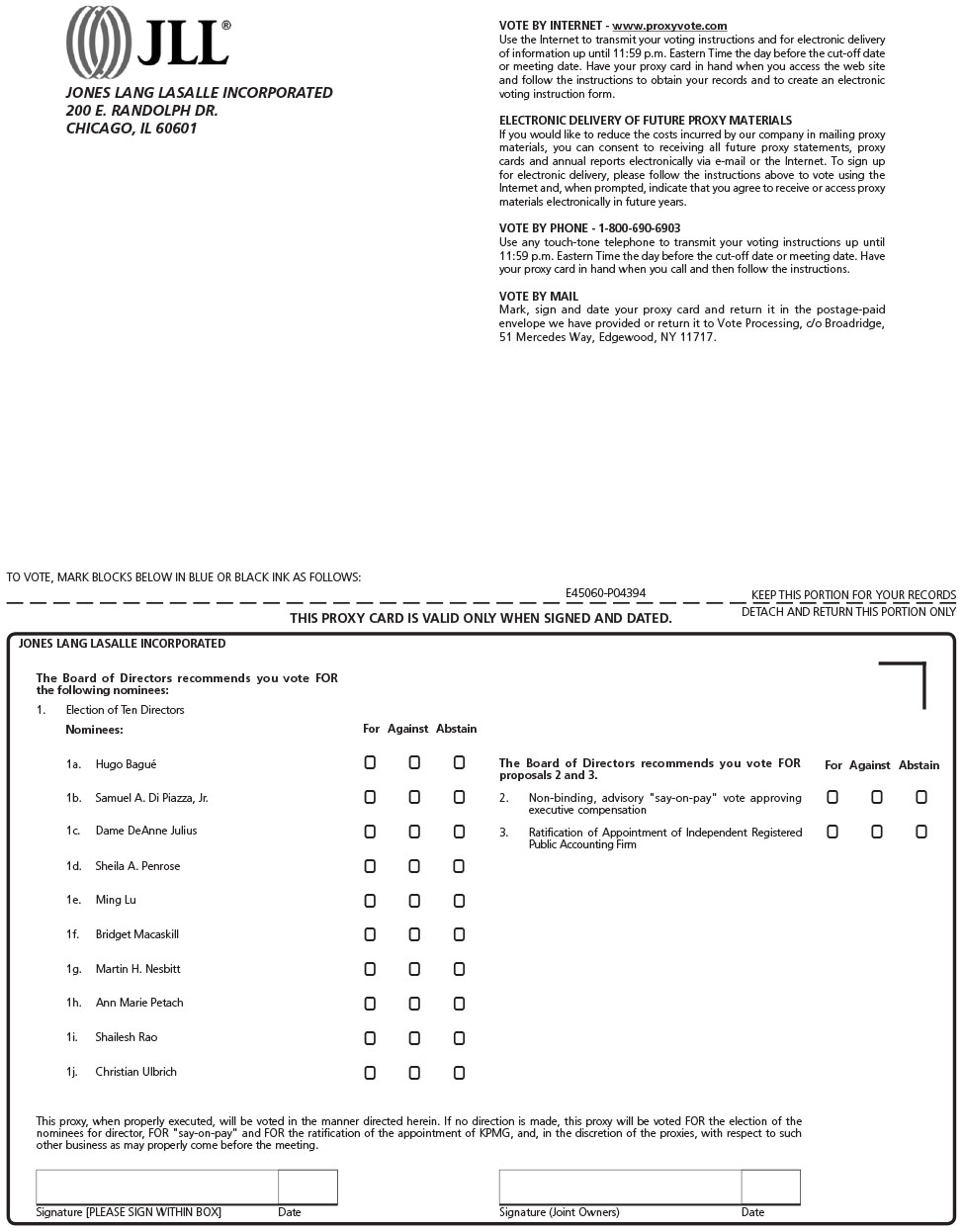

Q: | What items of business will be voted on at the Annual Meeting? |

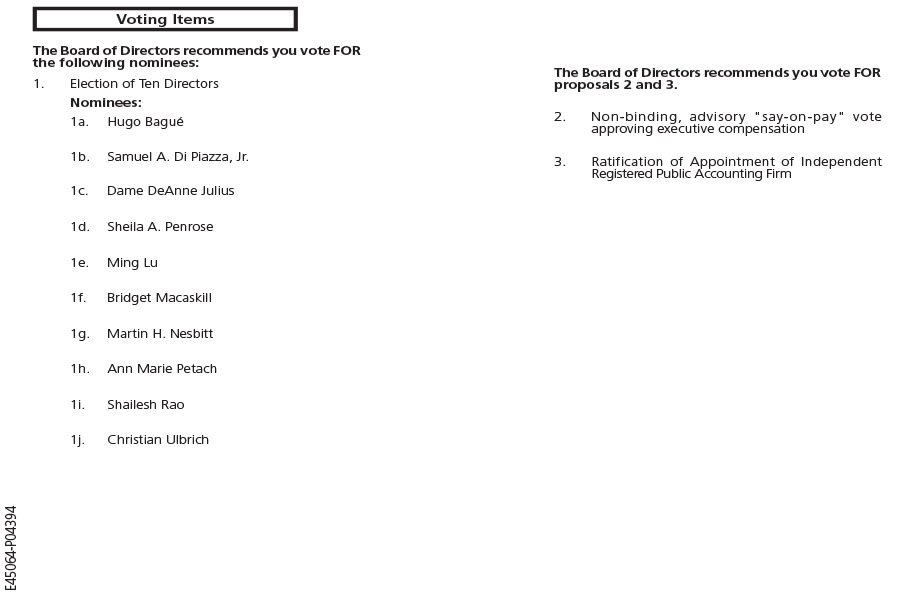

A: | The three items of business scheduled to be voted on at the Annual Meeting are: |

| • | Proposal 1: The election of ten Directors to serve one-year terms until the 2019 Annual Meeting of Shareholders; |

| • | Proposal 2: Approval, by non-binding advisory vote, of executive compensation (say-on-pay); and |

| • | Proposal 3: Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2018. |

Q: | How does the Board recommend that I vote? |

A: | Our Board recommends that you vote your shares as follows: |

FOR each of the tenand to serving as a Director, nominees to the Board;

FOR the non-binding advisory say-on-pay vote approving executive compensation; and

FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2018.

Q: | What shares may I vote? |

A: | Only shareholders of record of JLL’s Common Stock (NYSE: JLL), $0.01 par value per share (theCommon Stock), at the close of business on Thursday, March 15, 2018 (theRecord Date), are entitled to notice of, and to vote at, the Annual Meeting. Each share of Common Stock is entitled to one vote on all matters voted upon by shareholders and is entitled to vote for as many persons as there are Directors to beif elected. Based on the information we have received from Computershare, our transfer agent and stock registrar, there were 45,490,355 voting shares of Common Stock outstanding on the Record Date. The shares of our Common Stock are held in approximately 357 registered accounts. According to Broadridge Investor Communications, those registered accounts represent approximately 52,475 beneficial owners (which we believe includes the number of individual holders in certain reported mutual funds that hold our shares). |

Q: | What is the difference between holding shares as a shareholder of record and as a beneficial owner? |

A: | Most JLL shareholders hold their shares through a broker or other nominee rather than directly in their own names. There are some distinctions between (1) shares you hold of record in your own name and (2) those you own beneficially through a broker or nominee, as follows: |

| If your shares are registered directly in your name with JLL’s transfer agent and stock registrar, Computershare, then with respect to those shares we consider you to be the shareholder of record. As a shareholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting. |

| If you hold shares in a brokerage account or by a trustee or another nominee, then we consider you to be the beneficial owner of shares held “in street name,” and we are furnishing these proxy materials to you through your broker, trustee, or nominee. As the beneficial owner, you have the right to direct your broker, trustee, or nominee how to vote and we are also inviting you to attend the Annual Meeting. |

| Since a beneficial owner is not the shareholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, trustee, or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting. Your broker, trustee, or nominee has enclosed or provided instructions to you on how to vote your shares. |

Q: | How can I attend the Annual Meeting? |

A: | You are entitled to attend the Annual Meeting only if you were a JLL shareholder as of the close of business on Thursday, March 15, 2018 or you hold a valid proxy for the Annual Meeting.You should be prepared to present a photo identification for admittance. In addition, if you are a shareholder of record, we will verify your name against the list of shareholders of record on the Record Date prior to admitting you to the Annual Meeting. If you are not a shareholder of record but hold shares through a broker, trustee, or nominee (in street name), you should provide proof of beneficial ownership on |

| Proxy Statement | Page | 2 |

the Record Date, such as your most recent account statement prior to March 15, 2018, a copy of the voting instruction card furnished to you, or other similar evidence of ownership. If you do not provide photo identification or comply with the other procedures outlined above upon request, we will not admit you to the Annual Meeting.

Q: | How can I vote my shares in person at the Annual Meeting? |

A: | You may vote in person at the Annual Meeting those shares you hold in your name as the shareholder of record.You may vote in person at the Annual Meeting shares you hold beneficially in street name only if you obtain a legal proxy from the broker, trustee, or nominee that holds your shares, giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the Annual Meeting. |

Q: | How can I vote my shares without attending the Annual Meeting? |

A: | Whether you hold shares directly as the shareholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. Shareholders may deliver their proxies either: |

| • | Electronically over theInternet atwww.proxyvote.com; |

Bytelephone (please see your proxy card for instructions); or

By requesting, completing, and submitting aproperly signed paper proxy cardas outlined in the Notice of Internet Availability.

Q: | May I change my vote or revoke my proxy? |

A: | You maychange your vote at any time prior to the vote at the Annual Meeting. If you are the shareholder of record, you may change your vote by: |

Granting a new proxy bearing a later date (which automatically revokes the earlier proxy);

Providing a written notice of revocation prior to your shares being voted; or

Attending the Annual Meeting and voting in person.

A written notice of revocation must be sent to our Corporate Secretary at the address of our principal executive office, which we provide above. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares you hold beneficially in street name, you may change your vote (1) by submitting new voting instructions to your broker, trustee, or nominee or (2) if you have obtained a legal proxy from your broker, trustee, or nominee giving you the right to vote your shares, by attending the Annual Meeting and voting in person.

Q: | Who can help answer my questions? |

A: | If you have any questions about the Annual Meeting or how to vote or revoke your proxy, pleasecontact Broadridge Investor Communications at +1.631.254.7400. |

| If you need additional copies of this Proxy Statement or voting materials, please contact Broadridge Investor Communications at the number above or theJLL Investor Relations team at JLLInvestorRelations@jll.com. |

Q: | How many shares must be present or represented to conduct business at the Annual Meeting? |

A: | The quorum requirement for holding the Annual Meeting and transacting business is thatholders of a majority of shares of our Common Stock that are issued and outstanding and are entitled to vote must be present in person or represented by proxy. |

Q: | What is the voting requirement to approve each of the proposals? |

A: | The Company has established amajority-vote standardfor the election of Directors. Accordingly, in order to be elected, each Director must receive at least a majority of the votes cast for him or her by holders of Common Stock entitled to vote at the Annual Meeting. There is no cumulative voting for Directors. |

| Proxy Statement | Page | 3 |

Although the advisory vote on executive compensation is non-binding, our Board will review the result of the vote and, consistent with our philosophy of shareholder engagement, will take it into account in making a determination concerning executive compensation in the future.

| The affirmative vote of a majority of the total number of votes cast by holders of Common Stock entitled to vote at the Annual Meeting will be necessary to ratify theappointment of KPMG LLP as our independent registered public accounting firm for 2018. |

A: | For thepurpose of determining whether a quorum is present at the Annual Meeting, we will count shares of Common Stock represented in person or by properly executed proxy. We will treat shares which abstain from voting as to a particular matter and broker non-votes (defined below) as shares that are present at the Annual Meeting for purposes of determining whether a quorum exists, but we will not count them as votes cast on such matter. |

Accordingly, abstentions and broker non-votes will have no effect in determining whether Director nominees have received the requisite number of affirmative votes.

AbstentionsHow we select Directors

Identifying and broker non-voteswill also have no effect on (1) the voting with respectevaluating Director nominees The Nominating and Governance Committee employs a variety of methods to identify and evaluate nominees for Director. Candidates may come to the approvalattention of the non-binding vote on executive compensation or (2) the ratification of the appointment of KPMG LLP. Brokers holding shares of stock for beneficial owners have the authority to vote on certain“routine” matters, in their discretion, in the event they have not received instructions from the beneficial owners. However, when a proposal is not a “routine” matterNominating and a broker has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the broker may not vote the shares for that proposal.

A“broker non-vote” occurs when a broker holding shares for a beneficial owner signs and returns a proxy with respect to those shares of stock held in a fiduciary capacity, but does not vote on a particular matter because the broker does not have discretionary voting power with respect to that matter and has not received instructions from the beneficial owner.

Q: | What happens if I sign but do not give specific voting instructions on my proxy? |

A: | If you hold shares in your own name and yousubmit a proxy without giving specific voting instructions, the proxy holders will vote your shares in the manner recommended by our Board on all matters presented in this Proxy Statement. |

If you hold sharesGovernance Committee through a broker, trusteeBoard members, JLL executives, shareholders, professional search firms or other nominee and do not provide your broker with specific voting instructions, under the rules that govern brokers in such circumstances,your broker willnot have the authority to exercise discretion to vote your shares with respect to Proposal 1 (election of Directors) or Proposal 2 (say-on-pay).

Q: | What happens if a Director does not receive a majority of the votes cast for him or her? |

A: | Under our By-Laws,if a Director does not receive the vote of at least the majority of the votes cast, that Director will promptly tender his or her resignation to the Board. Our Nominating and Governance Committee will then make a recommendation to the Board as to whether to accept or reject the tendered resignation, or whether other action should be taken. The Board is required to take action with respect to the resignation, and publicly disclose its rationale, within 90 days from the date of the certification of the election results. If a resignation is not accepted by the Board, the Director will continue to serve until the next Annual Meeting and until his or her successor is duly elected, or his or her earlier resignation or removal. We provide additional details about our majority voting procedures under “Corporate Governance Principles and Board Matters” below. |

A: | As permitted by the Securities and Exchange Act of 1934 (as amended, theExchange Act), only one copy of this Proxy Statement is being delivered to shareholders residing at the same address, unless the shareholders have notified the Company of their desire to receive multiple copies of the Proxy Statement. This is known as “householding.” The Company will promptly deliver, upon oral or written request, a separate copy of the Proxy Statement to any shareholder residing at an address to which only one copy was mailed. Requests for additional copies for the current year or future years should be directed to our Corporate Secretary at the address of our principal executive office, which we provide above. Shareholders of record residing at the same address and currently receiving multiple copies of the Proxy Statement may contact our registrar and transfer |

| Proxy Statement | Page | 4 |

agent, Computershare, to request that onlysources. Tina Ju was identified by Egon Zehnder, a single copy of the Proxy Statement be mailed in the future. You may contact Computershare by phone at +1.866.210.8055 or by mail at 462 South Fourth Street, Louisville, Kentucky 40202. Beneficial owners should contact their bank, broker, or other nominee.

Q: | What should I do if I receive more than one set of voting materials? |

A: | There are circumstances under which you may receive more than one Notice of Internet Availability. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a shareholder of record and your shares are registered in more than one name, you will receive more than one Notice. Pleasevote each different proxy you receive, since each one represents different shares that you own. |

Q: | Where can I find the voting results of the Annual Meeting? |

A: | We intend to announcepreliminary voting results at the Annual Meeting and thendisclose the final results in a Form 8-K filing with the Securities and Exchange Commission (SEC) within four business days after the date of the Annual Meeting. |

Q: | What is the deadline to propose actions for consideration at next year’s Annual Meeting of Shareholders or to nominate individuals to serve as Directors? |

A: | Shareholder proposals intended to be presented at the 2019 Annual Meeting and included in JLL’s Proxy Statement and form of proxy relating to that Annual Meeting pursuant to Rule 14a-8 under the Exchange Act must be received by JLL at our principal executive office byDecember 22, 2018. |

Our By-Laws require that proposals of shareholders made outside of Rule 14a-8 under the Exchange Act must be submitted to our Corporate Secretary at our principal executive officenot later than March 2, 2019 and not earlier than January 31, 2019. In addition, any shareholder intending to nominate a candidate for election to the Board at the 2019 Annual Meeting must give timely written notice to our Corporate Secretary at our principal executive officenot later than March 2, 2019 and not earlier than January 31, 2019.

Shareholders may, subject to and in accordance with our By-Laws, recommend director candidates for considerationleading independent director-recruitment firm, retained by the Nominating and Governance Committee. The recommendation must be deliveredCommittee to our Corporate Secretary, who will forward the recommendation toidentify and help evaluate Director candidates, as a candidate possessing extensive experience and qualifications in key strategic and priority areas identified by the Nominating and Governance Committee for consideration.the new Director search. The Nominating and Governance Committee regularly assesses the size of the Board and determines whether any vacancies are expected due to departures.

Director qualifications Under certain circumstances, shareholders may also submit nominationsOur Board has adopted a Statement of Qualifications for directors for inclusion in our proxy materials by complying with the requirements in our By-Laws. We provide more information regarding proxy access under “How Do I Nominate a Director Using the Company’s Proxy Materials?” below.

Q: | How do I nominate a director using the Company’s proxy materials? |

A: | In March 2018, our Board adopted a “Proxy Access for Director Nominations” bylaw after engaging with a number of our shareholders. The proxy access bylawpermits a shareholder, or a group of up to 20 shareholders, owning at least 3% of the Company’s outstanding common stock continuously for at least three years as of the date of the notice of nomination, to nominate and include in the Company’s proxy materials director nominees constituting up to two individuals or 20% of the Board (whichever is greater), provided that the shareholder and nominee satisfy the requirements under Article III, Section 15 of the By-Laws. Pursuant to our By-Laws, to be timely for inclusion in the proxy materials for the 2019 Annual Meeting of Shareholders, we must receive a shareholder’s notice to nominate a director using the Company’s proxy materials by no later than December 22, 2018 and no earlier than November 22, 2018. Such notice should be addressed to the Corporate Secretary at our principal executive office and contain the information required by our By-Laws under Article III, Section 15. |

| Proxy Statement | Page | 5 |

DIRECTORS AND CORPORATE OFFICERS |

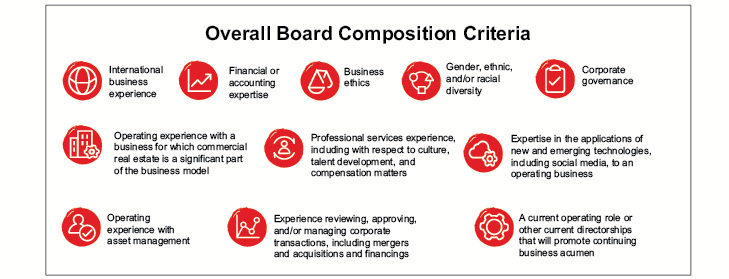

Biographical Information; CompositionMembers of the Board of Directors to outline the characteristics we seek in Board nominees. Briefly, we believe JLL Directors should have demonstrated notable or significant achievements in business, education or public service; they should possess the acumen, education and experience to make a significant contribution to the Board; and they should bring a range of skills, diverse perspectives and backgrounds to the Board’s deliberations.

Importantly, members of the Board must have the highest ethical standards, a strong sense of professionalism, and a dedication to serving the interests of all JLL shareholders. The Statement of Qualifications groups these desirable characteristics in three categories, as shown below. We provide below biographical summaries

To supplement the Statement of Qualifications, our Nominating and Governance Committee maintains an internal list of the more specific experiences and attributes that we want to have reflected on the Board. While we do not expect each Director to have all the desired experiences and attributes, we do seek to have them all represented on the Board as deeply as possible. When we are searching for each of:a new Director, we strive to fill any relative gaps in the overall composition of the Board. | jll.com |  | 2021 Proxy Statement 14 | 2021 Proxy Statement 14 |

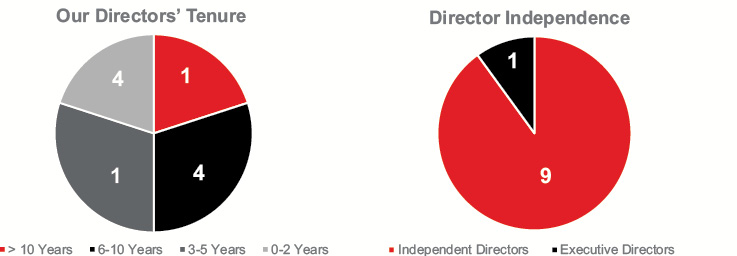

Back to Contents Summary of characteristics The following charts reflect various characteristics of our 2021 Director nominees. Our Directors’ ages, tenure, and diversity of background are well-distributed to create a balanced Board populated by individuals with years of experience working with JLL and our industry and individuals who bring fresh perspectives. All of our non-employee Directors are independent. Our nine current Non-Executive Directors standing for re-election;

One current Director standing for re-election who is a Corporate Officer; and

Our additional Corporate Officers. Director Qualifications

Summary of Board nominee experience and skills In addition to the caseminimum qualifications that our Board believes are necessary for all Directors, the following chart highlights certain skills and experience that are relevant to our long-term strategy, and therefore relevant when considering candidates for election to our Board. A mark for an attribute indicates that the nominee gained the attribute through a current or prior position other than his or her service on the JLL Board. Our Board did not assign specific weights to any of these attributes or otherwise formally rate the level of a nominee’s attribute relative to the rating for any other potential nominee. The absence of a mark for an attribute does not necessarily mean that the nominee does not possess that attribute; it means only that when the Board considered that nominee in the overall context of the composition of our Board of Directors, that attribute was not a key factor in the determination to nominate that individual. Further information on each nominee’s qualifications and relevant experience is provided in the individual biographies that follow the chart.   | 2021 Proxy Statement 15 | 2021 Proxy Statement 15

Back to Contents Our 2021 Director nominees A biography of each Director whonominee, current as of April 1, 2021, appears below. Tina Ju is a first-time nominee for electionas Director at the 20182021 Annual Meeting, we also provide below under “Three Proposals To Be Voted Upon At TheMeeting. Each of Ming Lu and Martin Nesbitt, who are current Directors, is stepping down as a Director when his term ends at the 2021 Annual Meeting — Proposal 1” a separate Qualifications Statement indicating those specific qualifications, attributes, and skills that support his or her membership on our Board of Directors.Meeting. Current Board Composition and Nominees for Election

Our Board currently consists of the following 10 members:

| Hugo Bagué | Bridget Macaskill | Ann Marie Petach | Samuel A. Di Piazza, Jr. | Martin H. Nesbitt | Shailesh RaoAge: 60 Director since 2011 | Dame DeAnne Julius | Sheila A. Penrose | Christian UlbrichCommittees: Compensation (Chair) | Ming LuNominating and Governance | | |  |  |  | | | |

All ofProfessional, Leadership and Service Experience

Mr. Bagué is currently the above Directors served for all of 2017 and through the date of this Proxy Statement. All of the above Directors are nominees for election. Changes in Corporate Officer Positions

Richard Bloxamwas named Global CEO Capital Markets effective January 1, 2017.

Allan Frazierwas named the Chief Information Officer effective September 1, 2017 upon the departure of David Johnson.

Judith I. Tempelmanwas named the Global Head of Corporate Development effective November 30, 2016.

Current Non-Executive Directors Standing for Re-Election

Hugo BaguéMr. Bagué, 57, has been aExecutive Director of JLL since March 2011. He isMilvusmilvus Consulting GmbH, a nominee standing for election to our Board at the 2018 Annual Meeting.consultancy company that he owns and runs. From 2007 until April 2017, Mr. Bagué was Organisational Resources Group Executive for Rio Tinto Organisational Resources with overall responsibility for Human Resources, Health, Safety, Environment and Communities, External Affairs, Media Relations, Corporate Communications, Procurement, Information Systems and Technology, Shared Services, and Group Property. Headquartered in the United Kingdom, Rio Tinto plc, is a leading international mining and metals group that employs 60,000 people worldwide in over forty countries. group.

Skills and Attributes Mr. Bagué was previouslybrings significant experience with employee relations, communications, safety, information technology and compensation issues, as well as perspectives on public relations, procurement, information systems and corporate sustainability. His work for other multi-national companies provides insights into operating within different cultures, business environments and legal systems, including both Continental Europe and emerging markets, and also within the global vice presidenttechnology and healthcare industries, both of Human Resourceswhich are important to JLL’s future growth strategy.  | Matthew Carter, Jr. | Age: 60 Director since November 2018 | Committees: Audit | Nominating and Governance |  |  | | | |

Professional, Leadership and Service Experience Mr. Carter is the Chief Executive Officer of Aryaka Networks, Inc., a leading provider of cloud and on-premises network applications. From 2015 to 2017, he served as President and Chief Executive Officer of Inteliquent, Inc., which provides wholesale voice services for the Technology Solutions Group of Hewlett Packard Corporation, based in Palo Alto, California.carriers and service providers. Prior to that he worked for Compaq Computer, Nortel Networks,role, Mr. Carter held various positions at Sprint Corporation from 2006 to 2015, including President of Enterprise Solutions, Sprint’s $14 billion global communications technology business unit. He previously served as a director of Apollo Education Group, Inc., a provider of higher education programs. Skills and Abbott Laboratories, based outAttributes Mr. Carter brings significant corporate leadership, brand management and technology experience, drawing from his executive roles at several large companies. His service on other boards enhances our capabilities in the areas of Switzerland, France,management oversight, corporate governance and Germany, respectively. He receivedboard dynamics. Other Public Company Boards Current: NRG Energy, Inc., an integrated power company (since 2018). Prior within last five years: USG Corporation, a degree in linguistics and post graduate qualifications in Human Resources and Marketing from the Universitymanufacturer of Ghent in Belgium.construction materials (2012-2018), Inteliquent, Inc., provider of voice telecommunications services (2015-2017).  | Samuel A. Di Piazza, Jr. | Age: 70 Director since 2015 | Committees: Compensation | Nominating and Governance |  |  | | | |

Samuel A. Di Piazza, Jr.Mr. Di Piazza, 67, has been a Director of JLL since May 2015. He is a nominee standing for election to our Board at the 2018 Annual Meeting. Professional, Leadership and Service Experience

Mr. Di Piazza retired as Global Chief Executive OfficeOfficer of PricewaterhouseCoopers International Ltd. (PwC) in September 2009, after eight years of leading the largest professional services firm in the world. OverDuring his thirty-six year36-year career at PwC, he led the US Firmcompany as Chairman and Senior Partner, the Americas Tax Practice, and was a member of the Global Leadership Team. After retiring from PwC, Mr. Di Piazza joined Citigroup, Inc., where he served as Vice Chairman of the Global Corporate and Investment Bank from 2011 until February 2014. Since 2010, Mr. Di Piazza currently serves onhas served as the Chairman of the Board of DirectorsTrustees of The Mayo Clinic. He is also a former Trustee of the World Economic Forum. Skills and Attributes Mr. Di Piazza brings to the Board valuable insights and perspective regarding the management of a multi-cultural, complex organization providing services to diverse client types across the globe. Mr. Di Piazza also brings significant accounting experience, including managing a tax practice and as part of standards-setting organizations. His service on the boards of other highly sophisticated organizations provides additional governance perspectives and experience with critical business issues, including cybersecurity. Other Public Company Boards Current: AT&T Inc.(since 2015), having previously served as a Director of DirecTV, Inc. prior to its acquisition during 2015 by AT&T, as well as ProAssurance, Inc., a property and casualty insurance company and(since 2014), Regions Financial Corporation, a bank and financial services company. Hecompany (since 2016).  Audit Audit  Compensation Compensation  Nominating and Governance Nominating and Governance  Chair Chair

| | | jll.com |  | 2021 Proxy Statement 16 | 2021 Proxy Statement 16 |

Back to Contents  | Tina Ju | Age: 55 First-time Director nominee | | | | |  |  | | | |

Professional, Leadership and Service Experience Ms. Ju is a founding and managing partner of KPCB China and TDF Capital, and currently a managing member of the general partner of both funds. She has more than 25 years of experience in venture capital, investment banking and operations. Ms. Ju began her venture capital career in 1999. She co-founded VTDF China in 2000 and KPCB China in 2007. Earlier in her career, Ms. Ju spent 10 years in investment banking including Deutsche Bank as the head of TMT and Transport Asia, Merrill Lynch as head of Asia Technology and Corporate Finance Team, and Goldman Sachs. Ms. Ju currently serves as a director on the Chairboard of the Board of Trustees of Mayo Clinic. Hevarious private companies. She is a member of the Executive Committee  | Proxy Statement | Page | 6 |

of St. Patrick’s Cathedral in New York City and The Inner City Scholarship Fund of New York City. He is a Trustee of the USA Foundation Board of the World Economic Forum and a member of the Executive Committee of the National September 11th Memorial and Museum. Mr. Di Piazza has served as a Trustee of the International Financial Reporting Standards Foundation, and is past Chairman of the Geneva-based WorldGlobal Leadership Council for Oxford Saïd Business Council on Sustainable Development, The Conference Board, Inc., Junior Achievement Worldwide, and the Financial Accounting Foundation, the oversight body of the FASB. Mr. Di PiazzaSchool. Ms. Ju received a B.S.bachelor’s degree in accountingindustrial engineering and operations research from the University of AlabamaUC Berkeley and an M.S.MBA from Harvard Business School.

Skills and Attributes In addition to the Universityextensive experience in venture capital, investment banking and operations Ms. Ju brings to JLL, her abilities to identify, engage and support some of Houston. Mr. Di Piazza isChina's most accomplished entrepreneurs and successful enterprises will be invaluable as we continue our focus on the co-author ofBuildingfuture growth potential in Asia, and particularly China. Other Public Trust: The Future of Corporate Reporting.Company Boards Current: Yiren Digital Ltd., a leading fintech company in China providing consumers with both credit and wealth management solutions (since 2015).  | Bridget Macaskill | Age: 72 Director since 2016 | Committees: Audit | Nominating and Governance |  |  | | | | | | |

Dame DeAnne JuliusDame DeAnne, 69, has been a Director of JLL since November 2008. She is a nominee standing for election to our Board at the 2018 Annual Meeting. Dame DeAnneProfessional, Leadership and Service Experience

Ms. Macaskill currently serves as an independent non-executive memberChairman of Cambridge Associates LLC, a global investment firm. Until July 2019, she was the board of directors of the University College London, one of the world’s leading universities, where she also serves asNon-Executive Chairman and, as an independent non-executive board member of the ICE Benchmark Administration, a wholly owned subsidiary of Intercontinental Exchange. Dame DeAnne was the Chairman of the Royal Institute of International Affairs, also known as Chatham House, from 2003 through 2012. Founded in 1920 and based in London, Chatham House is a world-leading source of independent analysis, informed debate and influential ideas on how to build a prosperous and secure world. From 1997 to 2001, Dame DeAnne served as a founding member of the Monetary Policy Committee of the Bank of England. Priorprior to that, she held a number of positions in the private sector, including Chief Economist at each of British Airways PLC and Royal Dutch Shell PLC, and was Chairman of the British Airways Pension Investment Management. She has also served as a senior economic advisor at the World Bank and a consultant to the International Monetary Fund. She previously served as a non-executive member of the board of directors of Roche Holding AG, a global healthcare and pharmaceutical firm, BP PLC, one of the world’s largest energy companies, and the board of partners of Deloitte UK, a firm providing audit, consulting, financial advisory, risk management, and tax services. Dame DeAnne has a B.S. in Economics from Iowa State University and a Ph.D. in Economics from the University of California. In January 2013, Dame DeAnne was knighted by The Queen of the United Kingdom for her services to international relations. Ming LuMr. Lu, 60, has been a Director of JLL since May 2009. He is a nominee standing for election to our Board at the 2018 Annual Meeting. Mr. Lu is a partner of KKR & Co., LP, a leading global alternative asset manager sponsoring and managing funds that make investments in private equity, fixed income and other assets in North America, Europe, Asia, and the Middle East. Mr. Lu joined KKR in 2006, and in 2018, was named Head of its Asia operation. In connection with his KKR position, Mr. Lu is a member of the board of directors of three of KKR’s portfolio companies, including MMI Group, a precision engineering company based in Singapore that provides components to the hard disc, oil and gas, and aerospace industries; Weststar Aviation Service Sdn Bhd, a helicopter transportation service provider to offshore oil and gas companies, and Goodpack Limited, a leader in steel intermediate bulk containers, a multi-modal, reusable metal box system that provides packaging, transportation and storage for global core industries. Prior to joining KKR, Mr. Lu was a Partner at CCMP Capital Asia Pte Ltd (formerly JP Morgan Partners Asia Pte Ltd), a leading private equity fund focusing on investments in Asia, from 1999 to 2006. Before that, he held senior positions at Lucas Varity, a leading global automotive component supplier, Kraft Foods International, Inc. and CITIC, the largest direct investment firm in China. Mr. Lu received a B.A. in economics from Wuhan University of Hydro Electrical Engineering in China and an M.B.A. from the University of Leuven in Belgium.

Bridget MacaskillMs. Macaskill, 69, has been a director since she was appointed effective July 1, 2016. She is a nominee standing for election to our Board at the 2018 Annual Meeting. Ms. Macaskill is the non-executive chairman of First Eagle Holdings, Inc. and serves as senior adviser to First Eagle Investment Management and to its CEO. She was formerly President and Chief Executive Officer, of First Eagle Holdings, Inc., a global investment firm, which she joined in 2009. Prior to joining First Eagle, Ms. Macaskill served as Chief Operating Officer, President, Chief Executive Officer and Chairman of Oppenheimer Funds, Inc., where she is recognized for creating the Oppenheimer Funds’ Women & Investing program, dedicated to educating American women about the need to take charge of their personal finances. Ms. Macaskill has served on a number of public company and not-for-profit boards andboards. She is currently on the boardsboard of Close Brothers plc, a merchant banking firm, and served on the board of Jupiter Fund Management plc., merchant banking firm Close Brothers plc.,plc until May 2020.

Skills and the TIAA-CREF mutual funds. A native of the United Kingdom, Attributes Ms. Macaskill earnedbrings her experience in investment management, finance, accounting, shareholder relations, leadership, enterprise risk management, compliance, and operations within a B.Sc.highly regulated industry. Ms. Macaskill also brings experience in Psychologycorporate social responsibility and diversity. Additionally, Ms. Macaskill brings perspectives on the English government and economy that will be useful as that country manages its exit from the University of Edinburgh and completed post graduate studies at the Edinburgh College of Commerce.European Union.  | Deborah H. McAneny | Age: 62 Director since 2019 | Committees: Compensation | Nominating and Governance |  |  | | | |

Martin H. NesbittMr. Nesbitt, 55, has been a Director of JLL since March 2011. He is a nominee standingProfessional, Leadership and Service Experience

Ms. McAneny served in various roles at John Hancock Financial Services for election to our Board atover 20 years, including most recently as Executive Vice President for Structured and Alternative Investments. Following that, she was the 2018 Annual Meeting. In January 2013, Mr. Nesbitt became the Co-Chief ExecutiveChief Operating Officer of The Vistria Group,Benchmark Assisted Living, LLC a private-equity investment firm. From 2000 until then, Mr. Nesbittfrom 2006 to 2009. Ms. McAneny served as President and CEO of PRG Parking Management (known as The Parking Spot), a Chicago-based owner and operator of off-airport parking facilities that he conceived and co-founded in August 2000. Prior to launching The Parking Spot, he was an officer of the Pritzker Realty Group, L.P., the real estate group for Pritzker family interests. Before that, Mr. Nesbitt was a Vice President and Investment Manager at LaSalle Partners, one of the predecessor corporations to JLL. He is a member ofon the board of directors of Norfolk Southern Corporation, oneHFF, Inc., a leading capital markets advisor, from 2007 until July 2019 when the company was acquired by JLL. She is also on the board of the premier rail transportation companies in the United States,University of Vermont Foundation and American Airlines Group, the holding company for American Airlines. Mr. Nesbitt is also a Trustee of Chicago’s Museum of Contemporary Art. He is the Treasurer for Organizing for America,  | Proxy Statement | Page | 7 |

the successor organization to Obama for America, a project of the Democratic National Committee,formerly served as trustee and is also the Chairman of the Barack Obama Foundation, the foundation created in January 2014 to establish the Barack Obama Presidential Library and Museum, among other things. He has previously been a memberchair of the board of directorsthe University of Vermont.

Skills and Attributes Ms. McAneny brings her extensive board experience, senior management expertise and significant familiarity with our business and industry, as well as particular knowledge of the Pebblebrook Hotelnewly acquired HFF business. Other Public Company Boards Current: KKR Real Estate Finance Trust, a real estate investment trustfinance company (since 2017), RREEF Property Trust, Inc., a non-traded REIT (since 2012), First Eagle Alternative Capital BDC, Inc. (f/k/a THL Credit Inc.), a business development company (since 2015). Prior within last five years: HFF, Inc. (2007- 2019).  | Siddharth (Bobby) Mehta | Age: 62 Director since 2019 Chairman of the Board since July 2020 | Committees: Audit | Nominating and Governance | Compensation |  |  |  | | | | | | |

Professional, Leadership and Service Experience Mr. Mehta was the former President and Chief Executive Officer of TransUnion, a memberglobal provider of credit information and risk management solutions, from 2007 to 2012. From 1998 to 2007, Mr. Mehta held a variety of positions with HSBC Finance Corporation and HSBC North America Holdings, including Chief Executive Officer of HSBC North America Holdings and Chief Executive Officer of HSBC Finance Corporation. Prior to that, he was Senior Vice-President at The University ofBoston Consulting Group and led their North American Financial Services Practice. Mr. Mehta also serves on several not-for-profit boards, including the Field Museum and the Chicago Laboratory School Board. Public Education Fund. Skills and Attributes Mr. Nesbitt has an M.B.A. fromMehta brings chief executive and senior management expertise in the University of Chicagofinancial services industry, including in banking and boththe credit markets. He enhances our marketing, brand management, technology-related and strategic experience. Other Public Company Boards Current: The Allstate Corporation (since 2014), Northern Trust Corporation (since 2019), TransUnion (since 2013). Prior within last five years: Piramal Enterprises Ltd., a Bachelor’s degree and an honorary doctorate degree from Albion College, Albion, Michigan.global business conglomerate (2013-2020). Sheila A. PenroseMs. Penrose, 72, has been | 2021 Proxy Statement 17 | 2021 Proxy Statement 17

Back to Contents  | Jeetendra (Jeetu) I. Patel | Age: 49 Director since 2019 | Committees: Audit Nominating and Governance |  |  | | | | | |